Passed in 2022 as America’s largest investment in climate and energy, The Inflation Reduction Act (IRA) is full of incentives and tax credits that can help 100 million homes save money on residential solar. The law also contains additional ways for Americans to save when electrifying their homes. To understand how homeowners plan to take advantage of this historical climate bill and start their clean energy journey, SunPower surveyed Americans across the nation about their energy preferences.

We learned that mounting electricity bills are giving rise to an energy-conscious consumer. There is a stronger desire to receive government assistance when adopting renewable energy sources like solar energy. In fact, 61% of Americans who are considering the switch to solar energy say they would do so if they received a government incentive.

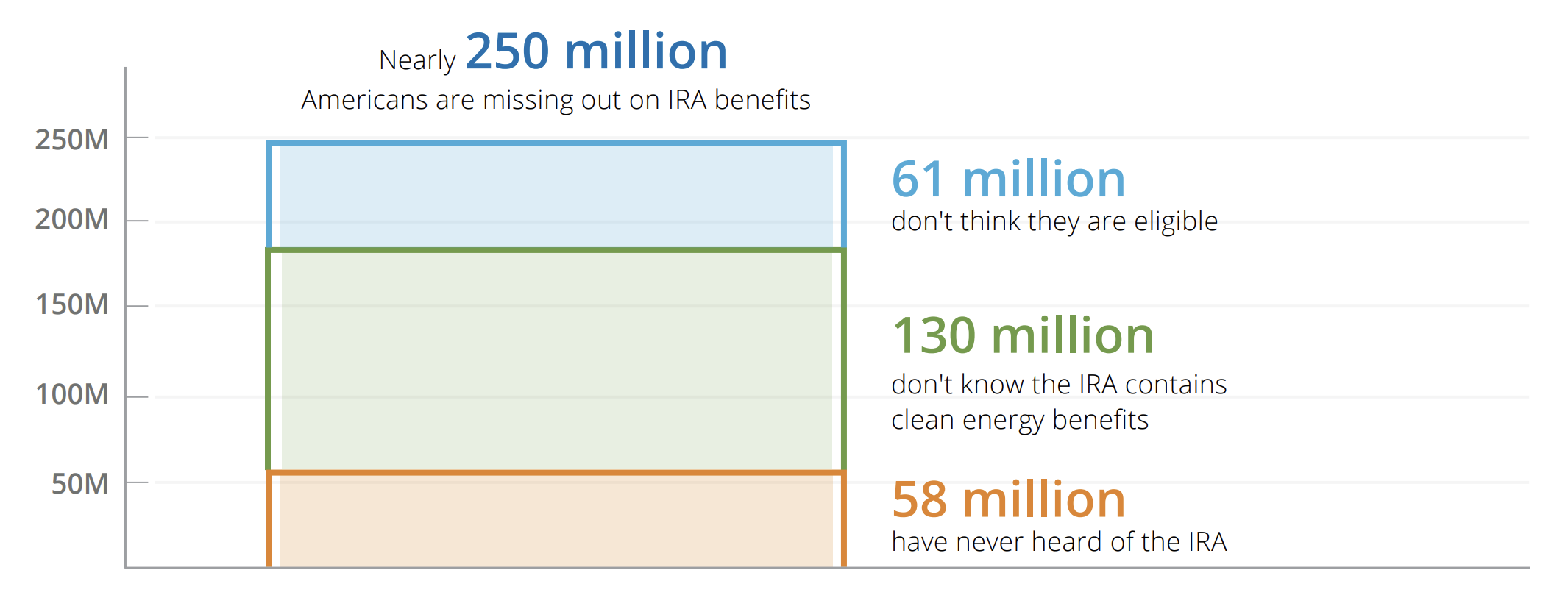

However, one in every four, an estimated 58 million people, have never even heard of the IRA. For those who are aware of the IRA, more than half (51%) don't know it offers tax credits for making energy efficient improvements to your home and over a third (39%) don't think they are eligible:

We get it. There’s a lot in the IRA, and it can be hard to understand how to best maximize the savings. Once people have heard about the IRA, they are 50% more likely to think that they can afford solar energy and two times as likely to say they plan to install energy efficient appliances like induction stoves or heat pumps.

We can help you be one of those people! Here’s some of our favorite (and easiest) tools to help you get smart and electrify your household:

Learn the top ten benefits available in the IRA

There is a lot to unpack in the 730-page policy. The good news? We read the bill so that you don’t have to! Here are the top benefits for people that want to save money on their electricity bills, make their home energy more reliable and reduce their carbon footprint.

The IRA is packed with various rebates and tax credits to help homeowners – and renters – transition to clean energy from purchasing electric vehicles to adopting solar power and heat pumps. If you’re ready to electrify but you’re not sure which rebates and tax credits you qualify for, then check out this easy-to-use IRA savings calculator from Rewiring America.

Find MORE tax credits and rebates for electrifying your home

One of the best things about the IRA is the extension of the solar Investment Tax Credit (ITC) that enables homeowners to receive an income tax credit worth 30% of the cost of the system until 2032. Now, there’s also one available for solar battery storage making this high demand clean energy solution more affordable, too! As you further electrify your home, don’t miss out on any of the savings. Check out the Department of Energy’s Savings Hub to see all the energy efficient technologies that are eligible for a refund.

Additional tools from our partners to help you get smart and save with the IRA

The journey to go green is different for everyone, but necessary for all to meet our nation’s ambitious climate goals. Here are some additional resources from our partners to help you make informed decisions along the way:

SEIA’s solar portal: A collection of free information that helps you learn about the different options for solar power, understand available financing and make the best decision for your family.

Department of Energy’s EV searcher: A platform that enables you to check out which electric vehicles qualify for the IRA’s tax credit and learn more about the requirements.

Sierra Club’s IRA fact sheet: A list of rebates and programs to make energy efficient upgrades to your home.

Want to learn more about how Americans feel about the IRA and top ways other homeowners plan to leverage the bill? Check out SunPower’s full Energy Switch Index.